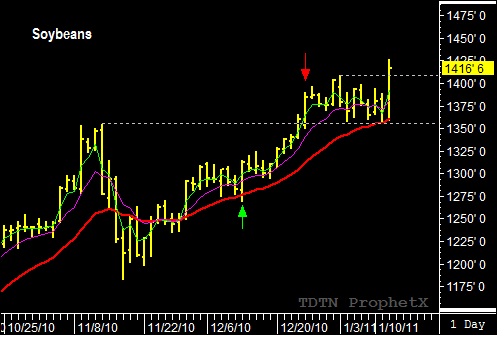

In the January 11th issue of the Traders Market Views Swing Trading report, I commented on a trade I had made earlier to sell March Soybeans, following a failed swing pattern on after Soybeans made a new high on January 3rd. Typically, a failed swing pattern will trigger a significant price move in the opposite direction of the breakout. Soybeans did not break to the downside as expected, but continued to drift sideways and continued to trade above the 20-day EMA instead. This price action was a red flag that the market was not behaving correctly and a warning that the new short position should be reconsidered. Because of the failure to properly follow through on the sell signal, I recommended to exit the short position and take a small loss. The following day, the USDA released a bullish crop report. Soybeans opened sharply higher touched limit-up…70 cents higher.

Learn more about price action in the Traders Market Views Swing Trading Report. For a free 30-day free trail subscription go to www.tradersnetwork.com