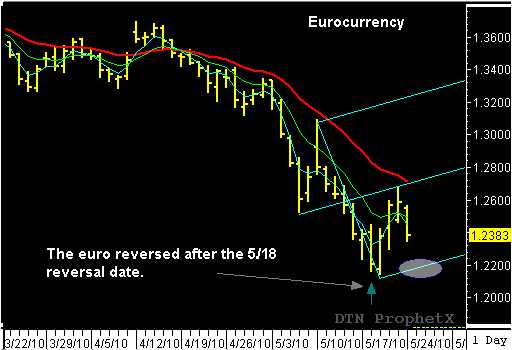

The June eurocurrency bottomed at 1.2163, a confluence of support where the down-sloping line parallel line intersected with the up-sloping reaction line. The market reversed on the May 18 reversal date and rallied over 450 points in the following three sessions. The three-day rally stalled at 1.2674, when it tested the newly established up-sloping median line on Friday, May 21, 2010 and reversed lower. A market will typically trade to the median line up and reverse a high percentage of the time. The euro should trade lower and test the lower up-sloping parallel line support before turning higher (highlighted on the chart). If the support holds and the market bounces off the parallel line with good separation, it will off a new buying opportunity. I will have updated information on the euro in the TMV Swing Trade Report.