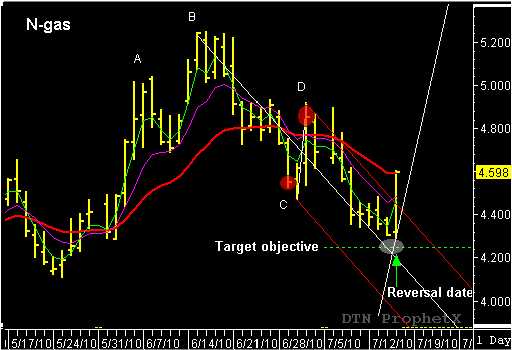

Natural gas surged over a $3,000 higher, after posting a bottom at 4.288 on the projected reversal date! The TMVSwing Trading Report had been short August Natrual gas from 4.550 ( recommended in July 8th issue). The target objective was 4.250 with a projected reversal date due on July 15th. I was looking for the N-gas to trade lower into the July 15th reversal date or reach the 4.250 target objective on or before July 15th. The market came up shy of the price objective–missing by only 38 points–before the reversal date kicked in. The market had traded below the July 14th low, reaching 4.288, before heavy short-covering turned the market and new buyers followed. N-gas surged to a high of 4.587 before mid-morning. Having been forewarned (July 15th reversal date) of a possible rally I recommended exiting at 4.340 and locking in a nice gain on the swing trade.

Both the reversal date and price target objective were made five days in advance, by using the June 29th – July 1st reaction swing with the reverse count to the June 15th high.

This is a great example of “action-reaction” working in conjunction with the projected reversal date to complete a successful swing trade signal.

By John Crane