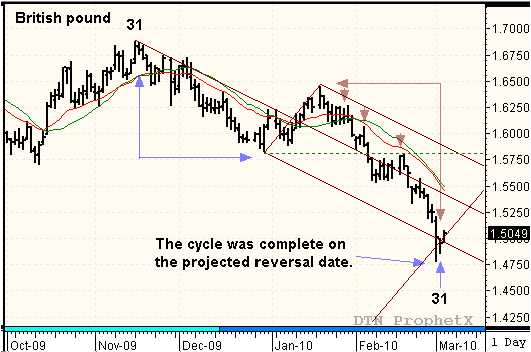

Based on the 12/29 – 1/19 A-B-C continuation pattern, the Brithis pound has completed the reaction cycle and is due for a corrective rebound or begin a consolidation period. The pound reached the lower reaction line target objective, one day before the final reversal date (projected for March 2, by the reverse/forward count). The lower parallel line was drawn after the market breached the upper reaction line and traded sharply lower into the final reversal date.

This cycle began on January 21, when the British pound confirmed the high pivot (1/19). This high pivot point marked the end of the A-B-C continuation pattern, which typically acts as a center point of a longer-term trend. Based on that knowledge, the reverse count of 12, 21, 27 and 31 days projected futures reversal dates of 2/3, 2/16, 2/24 and a final date of 3/2. The first three reversal dates identified swing highs and trend c0ntinuation patterns (marked with red arrows). It was not until the market reached the final reversal date and the lower reaction target objective, that the market completed the cycle and began to reverse. This is a good example of how the “action/reaction” method can be used to project future time and price target objectives when swing trading.

I couldn’t resist commenting. 🙂

Thank you for you interest in my information.

These tips are so true

Good Day! I Just found this site and I really love it.cu

I would appreciate more visual materials, to make your blog more attractive, but your writing style really compensates it. But there is always place for improvement

How-do-you-do, just wanted you to know I have added your site to my Google bookmarks because of your extraordinary blog layout. But in earnest, I think your site has one of the freshest theme I’ve came across. It really helps make reading your blog a lot simpler.

It is useful to try everything in practice anyway and I like that here it’s always possible to find something new. 🙂

Super-Duper site! I am loving it!! Will come back again – taking you feeds also, Thanks.

Besides the disciplined approach, I believe the most difficcult part of forex trading was understanding the processes and terminology of this dynamic money spinning environment.