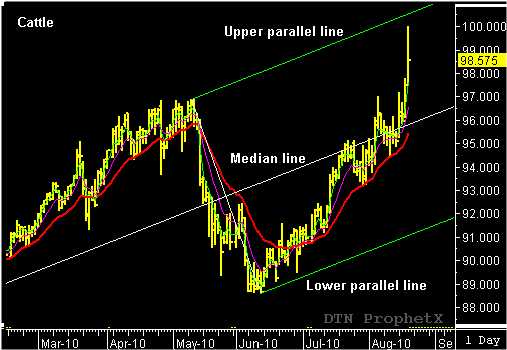

Dr. Alan Andrews stated that when a median line (the white center line) is drawn, from the most recent swings, the price should return to the medain line 80% of the time. This median line can be used as a target objective where the market will often form a new pivot. October Cattle first tested the median line on July 21 when it traded to a high of 95.02. After a second test, on the following day, Cattle reversed, forming a high pivot and dropped to the 20-day EMA, trading as low as 93.25 on July 29. So far, the market had been following price behavior described by Dr. Alan Andrews.

He also stated that when a price returns to the median line the price will often form several small swings around the median line where it will touch or cross the line more than once before moving on. October Cattle tested the median line for the second time on August 2 and crossed above the line on August 4, only to back off and drop below the line on August 10. So far, so good. The market is behaving according to the plan. But, this is where it gets interesting. Each time Cattle crossed above the ascending median line, the market would pull back and close near the median. It was not until August 18 when Cattle posted a strong close with good separation from the median line. This was another “market tell” that Cattle are ready to resume the upward trend with a new target objective at the upper parallel line. Remember, price will continue to move towards the nearest line 80% of the line. In this case the upper parallel line is the new objective.

Understanding market behavior can and will alert you to trading opportunities and allow you to be aware if the market is behaving correctly so you can take advantage of this behavior. It is all between the lines. Learn more about using ‘action-reaction” lines and swing trading strategies at www.tradersnetwork.com.

By John Crane