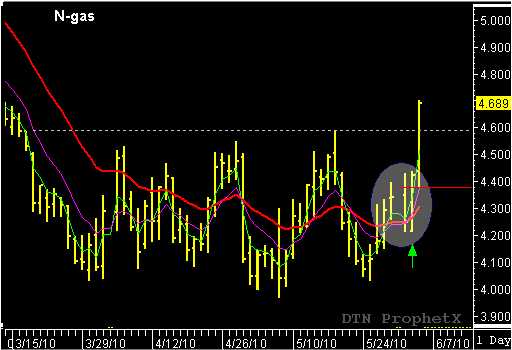

July N-gas began to consolidate into a choppy side way trading pattern in late March. The market stayed inside the 4.600 to 4.000 price range for over two months before finally breaking out and trading sharply higher on June 3. While a side way consolidation pattern can offer trading opportunities for the astute swing trader, the risks are increased when the market lacks momentum after a signal. However, all that changed during the last upward swing in the July N-gas. Between May 28 and June 1, N-gas formed its first bullish reaction swing and a retest of the 20-day EMA. This was a change of behavior from the prior three upward swings that occurred during the two month long consolidation. This was the first “market tell” that something had changed and it was time to pay attention to the N-gas. The reaction swing was bullish in nature, therefore suggested a possible bullish breakout with a buy trigger price at 4.435. The next day, the buy signal was triggered and the N-gas and rallied to a new two and half month high.