Reversal dates in both Gold and Silver triggered a sharp rally in both metals. The price action in gold suggests a possible swing pattern failure that could portend a new run at the old high, after a corrective pullback. Silver traded over $1.80 higher Tuesday’s session and bounced off the lower support level of the three-month long consolidation pattern.

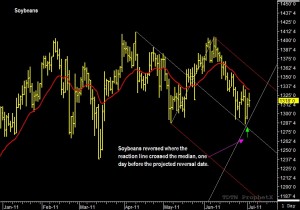

Grains also posted an impressive turnaround during the projected reversal time period. The gap-and-go pattern in Wheat is bullish and could set the stage for a significant recovery and test of the June 29th swing high price of $6.98 1/2. Pullbacks should offer buying opportunities over the next couple of days. Looking a the November Soybeans, I see a swing trading opportunity unfolding right now. The market tested the reaction support on the reversal date and formed a . This price action is bullish and sets up a bullish buy signal. For more information of this and other swing trading opportunities, call us at Traders Network 1-800-521-0705.