Swing Trading with Market Timing Intelligence

Swing trading has emerged as the fastest growing trading strategy in the industry today. Long preferred by professional traders, swing trading is being discovered by a whole new generation of serious traders and investors.

Everyone knows the old adage “follow the trend.” Traditional swing trading strategies were developed to take advantage of the trend and attempt to capture the price swings that occur between levels of consolidation inside the trend. However, most traditional swing trading strategies fall short of achieving that goal because they rely on lagging indicators, such as SSTO, RSI or moving averages. These indicators are known as lagging indicators because they do just that; they lag behind the market. They are late to enter and late to exit. In the fast-paced markets of today, you can’t afford to lag behind!

There is one swing trading strategy that stands head and shoulders above all the rest because it is known as a “leading indicator.” “Action/Reaction,” combined with Market Timing Intelligence, is the only strategy to give you all three essential components— market direction, price projection and trade duration—needed for a successful swing trade.

“Action/Reaction” uses the market’s own recent price action to identify “sweet spots” where markets build energy inside a trend that precede explosive market moves, and then attempts to capture the entire price swing from beginning to end.

As a leading indicator “Action/Reaction” not only triggers signals at the beginning of the of the price move, but provides the information needed to project how far the price is expected to move, and how long it will take the market to reach the target objective.

While most traders put their emphasis on the timing of the entry, “Action/Reaction” puts just as much emphasis on the exit. The wrong “exit” strategy can ruin a good trade, while the correct “exit” strategy can turn a marginal trade into a successful trade. Unlike other swing trading strategies that only give you half the information needed for a successful trade signal, the “Action/Reaction” swing trading strategy provides all the information necessary for a swing trader to succeed.

While most swing trading strategies are forced to wait for the trend to mature before any signals can be taken, “Action/Reaction” swing trading strategy provides the tools to take advantage of the entire trend, from the beginning to the end. “Action/reaction” allows the trader to enter early and be positioned before other swing traders begin to enter and exit, or before the market loses momentum and begins to correct…thereby taking advantage of the entire trend.

Here’s your opportunity to see what you can accomplish with a professional grade swing trading strategy. Only “Action/Reaction” offers Swing Trading with Market Timing Intelligence!

“Action/Reaction” with Market Timing Intelligence is the strategy used in the Traders Market Views Swing Trading Report. I have included last night’s issue as an example of the strategy in action. “Action/Reaction” Market Timing intelligence is also the foundation of the highly acclaimed Systematic Swing Trader software (SST). The SST does all the work for you as it scans 26 markets to identify swing trade opportunities. Then, it takes over and manages the trade for you automatically!

“Action-Reaction” with Market Timing Intelligence is the strategy used in the Traders Market Views Swing Trading Report. He are two recent examples of “Action-Reaction” at work in two very volatile markets.

First a look at the latest trade recommendation in December Coffee. The market formed a bullish reaction swing between October 25 and November 3, with a spike down to support on November 3. This pattern is considered a TC pattern (trend continuation) and signaled a new upward price swing in Coffee. The buy signal was triggered at 201.05 on November 4. The “Action-Reaction” reverse/forward count was used to make two projections, a future reversal date for November 9 with a target objective at 217.55. You can see on the December Coffee chart below, that Coffee rallied to a high of 218.70 and reached the downward sloping reaction line target objective on November 5…one day after the projected reversal date! A few hours later, the market was trading at 212.40! “Action-Reaction” Market Timing Intelligence got it right!

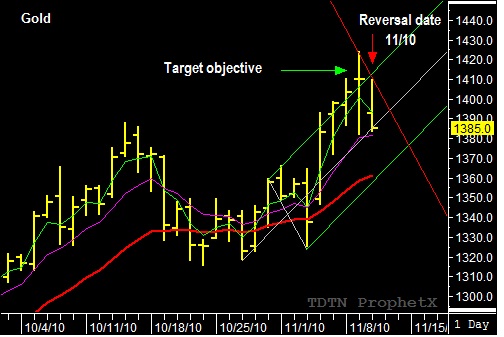

For the second example, I will take a look at December Gold. Gold formed a bullish reaction swing between October 29 and November 3. The pattern confirmed and triggered the buy signal on 11/4, when the market traded above the swing pattern high of $1366.40. The “Action-Reaction” time and price projections indicated Gold should continue to trade higher into the November 1o reversal date with a target objective at $1424.00 to $142500, identified by t he intersection of the ascending upper parallel line and the downward sloping reaction line. Gold traded to a high of $1424.30 on November 9, before reversing and falling over $40.00 during the before the end of the November 1oth reversal date.

To learn more about “Action-Reaction” and Market Timing Intelligence go to www.tradersnetwork.com and sign up for a free trial subscription to the TMV Swing Trading Report.