On Wednesday, November 10, 2010, I posted two charts, one for the December Gold and one for the December Coffee. I discussed the “Action-Reaction” time and price projections for both markets and illustrated how the strategy timed the entry and exits signals for both markets. This is a follow up to that post with an update for both markets and following market action. Both markets illustrate the sharp contracts in swing trading strategies. While most traditional trading strategies put their emphasis on the entry, “Action-Reaction” not only triggers signals at the beginning of the price move, it also puts just as much emphasis on the exit. A good exit plan can save a bad trade, just as a bad exit plan can ruin a good trade.

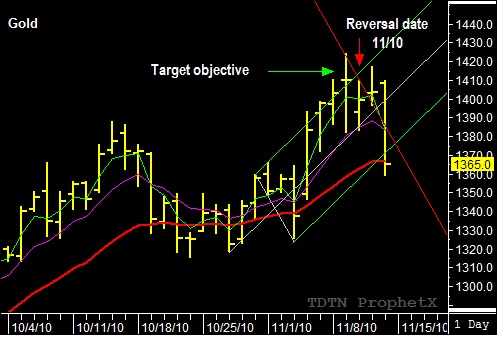

In the December Gold example, the reaction line target objective was reached on November 9th when Gold traded to a high of $1424.30, one day before the projected reversal date. This provided an excellent exit to close the trade. Compare this to a swing trading strategy that did not provide the target objective and only followed with a stop loss, the exit could have been as low at $1381.00…over $4,400 lower!

As you can see from the chart below, Gold continued to respect the reaction line and reversal date, projected by the “Action-Reaction” trading strategy several days earlier. Gold is currently trading at $1364.00. That is $64.00 lower during the following two days after the projected reversal date.

Here is another look at the December Coffee chart, also three days later. Coffee peaked at the intersection of the downward sloping reaction line and the ascending median line. The market also reached the climax on the projected reversal date and closed the recommended trade at 217.55. Three days later, Coffee is trading at 200.30…a difference of 1755 points.

Market Timing Intelligence can make a difference! Learn more at www.tradersnetwork.com