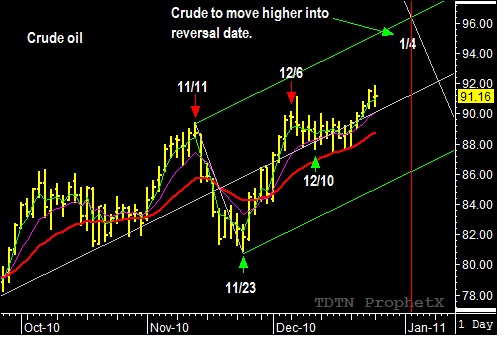

Crude oil futures remain above the ascending median line support and continue to climb into the January 4th reversal date. The market has been following the bullish cycle in textbook fashion, after breaking out of the latest reaction swing pattern, formed between December 6, 2010 and December 10. 2010 reversal dates. The upward trend is also being supported by accounting rules that aid refineries that allow stocks piles to decline into the end of the year. If history repeats itself, Crude may experience a significant reversal after the January 4th reversal date.

Accounting rules allow refiners to take a bigger 2010 tax deduction by cutting stockpiles that have jumped this year as prices increased. According to Bloomberg.com, Gulf Coast supplies fell in 27 of the past 29 Decembers. They have risen in four of the past five Januaries.

Companies typically expense the cost of items they have sold from their taxable income. Many refiners use an accounting method known as “last in, first out,” or LIFO, which allows them to deduct the cost of the more-expensive crude they have purchased most recently and assert for tax purposes that the oil in their tanks was bought before at cheaper prices. In years when prices rise, companies get a bigger tax deduction via LIFO accounting if they manage their supplies so that their inventories at year-end are close to the levels at which they started the year.

To help you time your exits of long positions or entry for a possible short position, keep checking the daily updates of the TMV Swing Trading report.