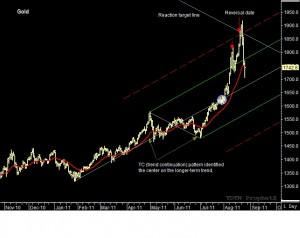

As I listened to the talking heads, on the business news channel, talk about the unexpected collapse in the Gold and Silver, I was thinking, “Was this really a surprise?” I look back to the August 19, 2011 issue of the TMV Swing Trade report where I talked about the price action in the Silver and Gold suggesting a possible climax to the accelerating trend. Using action/reaction analysis I had projected a major reversal date for August 19, 2011, in the Gold…I missed it by one day! Gold had just traded out of a bullish reaction swing and had reached a confluence of resistance where the upper parallel warning line intersected with the reaction target line. The action/reaction time and price projections were waving a red flag the market had reached the target objective and overdue for a significant reversal. Three trading session later, Gold is trading $180.00 lower!

Understanding how market structure and price behavior influence the market action are essential in the volatile markets we are experiencing right now. For more information on how these time and price projections were made, visit www.tradersnetwork.com. By John Crane