One on the most useful median line trading principles comes into play after the market trades through and closes beyond the median line. This is an indication of strength and it also identifies a low-risk entry point to allow traders to get on broad, if they missed the initial price move, or wish to add to existing positions.

This Andrew’s trading principle states that a market will typically pull back and test the median line, after it has passed through and closed beyond the line. The key to using this principle, as an entry point, is to make sure the market has penetrated the median line with significant momentum and closed with enough distance to confirm the “zoom bar”.

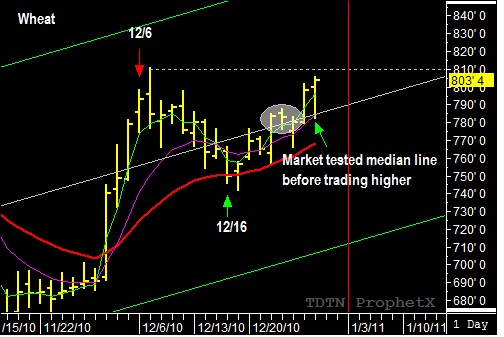

March Wheat is currently showing a very good example of this “zoom bar” signal pattern. Wheat had been trading on both sides of the ascending median line when it formed a bullish reaction swing between December 22 and December 27. The reaction swing triggered a sharp rally on Tuesday (December 28th) that pushed Wheat through the median line and closed seventeen cents beyond the median line…confirming the “zoom bar” buy signal. This allows the trader to place an order to buy March Wheat at the $7.85, on the median line. The following day, Wheat opens at $8.00 before it dips down to a low of $7.82–testing the median line–before reversing and trading higher. The market is currently trading at $8.04

Using this trading principle provided the trader with a low-risk entry price, before Wheat resumed the upward trend.

For updates on the current wheat recommendation and other swing trading strategies go to www.tradersnetwork.com and sign up for a free 30-day trial subscription to the TMV Swing Trading Report.